Investrly Thoughts 🌐 (David V Goliath - Reddit/Gamestop)

Investrly Strategy (Goodbye, Robinhood)

Investrly All-Star Team (Top 7 Crypto Edition)

Investrly Stock and Cryptocurrency pick of the week

Investrly Education of the week (Term, Quote, Recommended)

Interested in discussing investing live and asking questions? Join the investrly zoom call every Monday at 4:30PM PT / 7:30PM ET.

Investrly Thought of the Week

(David V Goliath)

One thing about long term investing is understanding the unpredictable nature of markets in the short term. What happened last week was a black swan event. It turned the stock market upside down and exposed it’s David vs Goliath nature. A Reddit chat room with millions of members called r/WallStreetBets (David) financially taking on Wall Street hedge funds (Goliath) and winning!

No possible way. Except in this case. Yes in every way. They did so by creating a massive "short squeeze" in stocks such as GameStop and AMC.

While the hedge funds took short-selling positions, giving them profits if these stocks went down, the millions of frustrated retail investors bought the stocks, driving their prices up several hundred percent each day. This massive buying action forced the losing hedge funds to cover and dump their short-selling positions. In turn, losing billions of dollars in the process. Against all odds, the retail investors were not only winning, but looking to other assets to gain momentum. David was destroying Goliath. This was until centralized brokerage firms such as Robinhood forbade the buying of certain stocks, unfairly changing the rules in the middle of the game.

In this case, Goliath was caught being overzealous, displaying dangerous risk management, and being unprepared for a short term event that would stop them from having a long term future. This type of investing strategy simply cannot happen. The unpredictable nature of markets will continue forever. As a long term investor, use investment strategies which allow you to maneuver tumultuous short term events.

One of those strategies is recognizing opportunity and acting on it.

The recognition from this ongoing moment is the need for decentralization. Acting on this opportunity, expect to see an acceleration in the trend of investors moving towards decentralized finance (defi) platforms allowing them complete ownership of their futures.

I spoke specifically about defi in the crypto portion of volume 3.

Investrly Strategy of the Week

Goodbye, Robinhood (Invest in brokerage accounts)

The brokerage firm Robinhood, which since inception had embraced the young retail investors new to the markets, once said "Let the people trade." Well, after this week's abysmal and deceptive actions taken by Robinhood, which swiftly prevented the trading of certain stocks to "protect their customers from market volatility," there is no way I can support using their platform going forward. These actions were flat out wrong and a mistake which may cost Robinhood their brand.

The two most important questions and concerns now;

1. Is my money safe in Robinhood? In short, yes, you're insured up to certain amounts. Click the link to read the full terms.

2. What platform should I use? This depends on your investing experience and are you looking to trade derivatives. I recommend using a platform from the standpoint of usability, display, and convenience in both desktop and mobile apps. Here are two brokerage platforms below, from beginner to advanced that I recommend and I will continue to monitor the investing space for new options.

Public - A beginner style social media investing platform great for new investors. At this time, this platform does not offer options.

Fidelity - An advanced platform great for all investors offering everything from stocks to options.

Investrly All-Star Team (Top 7 Crypto Edition)

Where you can investrly in cryptocurrency. (Gemini)

Investrly Stock

Apple - $AAPL

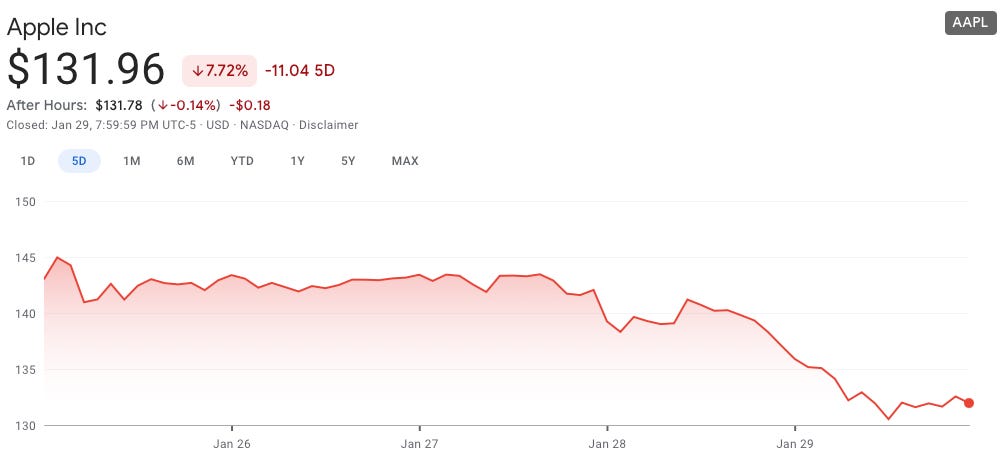

You know Apple. It's a fantastic company with stellar products and services that have changed our lives in so many ways over the years. Chances are you're reading this article on an Apple product right now. What you may not know is that Apple released their financial earnings report this past week, and the numbers were nothing short of absolutely MIND-BLOWING! Somehow though, the stock went down...weird, right? Here's a little secret; due to the Gamestop "short squeeze" event from this past week, many of the losing hedge funds were forced to sell their winning stock positions, such as Apple, in order to offset their massive Gamestop losses. A special situation presents itself...an opportunity to buy Apple on a short term dip that leads to long term gains.

"A masterpiece quarter" Four market analysts on Apple’s Q1 earnings beat.

Investrly Crypto

The Graph - $GRT

Cryptocurrency is here and it’s a lot more than Bitcoin. Enter “The Graph”. The Graph is an indexing protocol for querying networks like Ethereum. Anyone can build and publish open APIs, called subgraphs, making data easily accessible. Similar to how Google indexes every website, The Graph can index every blockchain. Massive potential. Very early in development.

Read about The Graph Network in Depth

Investrly Term of the Week

Black Swan

A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight.

Read more about black swan events.

Investrly Quote of the Week

Investrly Recommended

Invest early in yourself:

Join the @Investrly community:

Have a suggestion, comment, or question. Drop it below.

Looking to sponsor or advertise in a future newsletter, reach us at pleaseinvestrly@gmail.com.

See ya next week. Share this newsletter with a friend so they too can invest early. Get more investrly daily on twitter.

Not financial or tax advice. Investrly the newsletter is 100% educational and is not investment advice or a solicitation to make any financial decisions. This newsletter is not tax advice. Talk to your accountant and do your own research.