LUNA & UST: Crypto Collapse²

72 🍉 Terra Collapse, Inflation, Emirates/Bitcoin + MLB Fantasy NFT game, Julie Pacino & DaySlice.

The Collapse of Terra’s LUNA and UST stablecoin

NFT Corner: Zagabond and Azuki

Web3 News: Emirates to accept Bitcoin, Sorare launching MLB NFT fantasy game

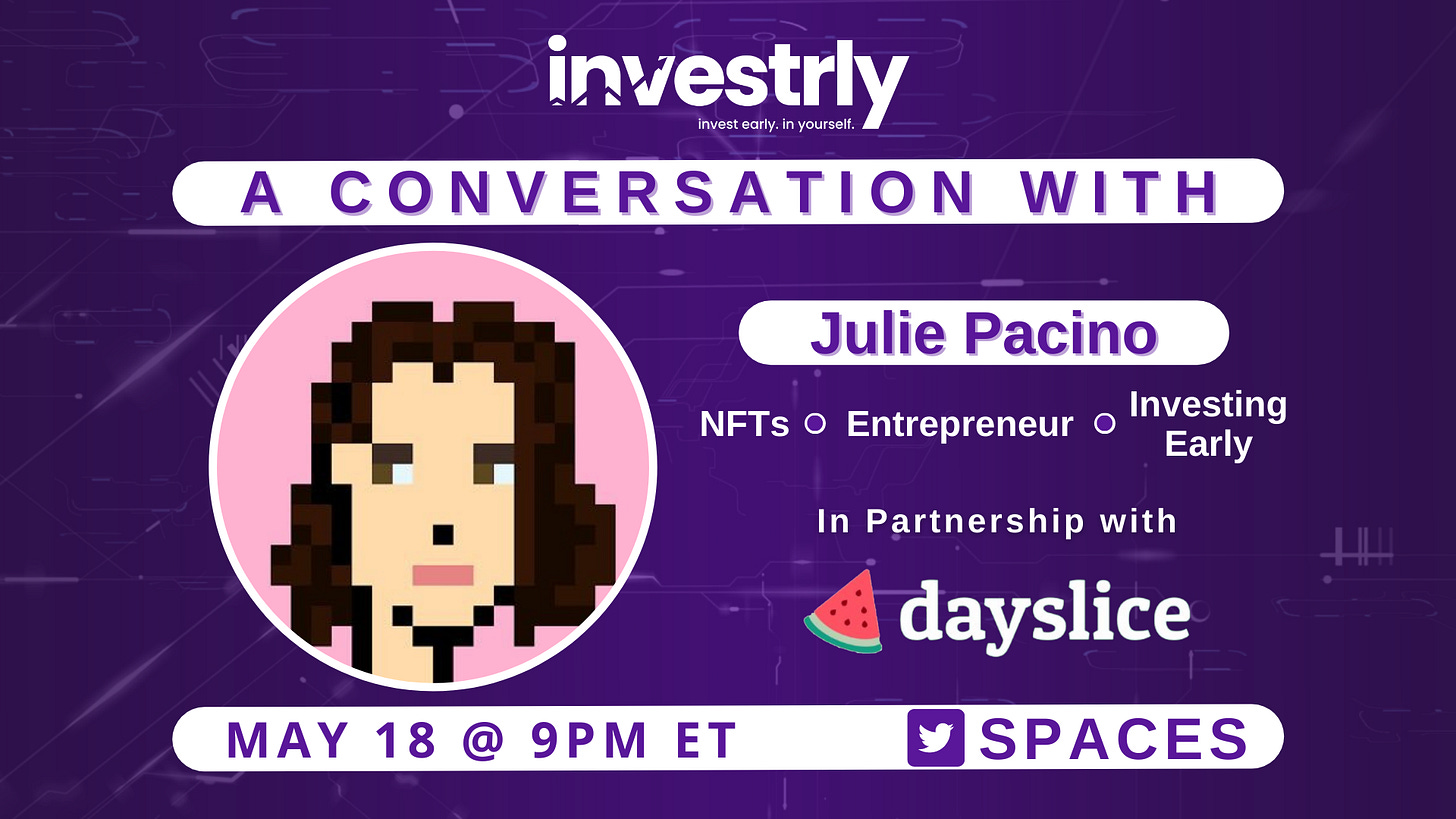

Wednesday 5/18: A Conversation With Julie Pacino

Win 2 passes to Consensus 2022 in Austin, TX

Volume 72: Web3 news and opportunity keeping you informed together with Dayslice, which offers:

Easy scheduling and enhanced branding tools

Social proofing with testimonials

Upfront pricing with payment options for users

Sign up today with the code “investrly” and enjoy the Dayslice Pro Plan for $1.

The Terra Tornado

Over the past week, the crypto ecosystem experienced an F5 tornado scenario. The cryptocurrency Terra, a blockchain project with the LUNA token and UST Stablecoin, completely collapsed. Terra’s token, LUNA, which was a top 10 token by market cap, went from $112 to fractions of a penny in a matter of days. Terra’s stablecoin, UST, de-pegged and crashed from $1 to as low as 14¢ confirming it was not stable in any way. Terra’s blockchain was also halted for several days.

In April, the Terra ecosystem market cap was ~$60 billion+. Today in May, the entire ecosystem has completely evaporated due to the death spiral. It’s important to note as far back as 2021, people were sounding the alarm that the Terra ecosystem was flawed. Users even outlined exactly how it could be victim to an attack:

The UST “not so” Stablecoin

In cryptocurrency, stablecoins are designed to be tokens pegged to the US Dollar, meaning each stablecoin token “should” always be worth 1 US Dollar. Large stablecoin companies include: Circle (USDC), Gemini (GUSD), Binance (BUSD) and Tether (USDT). The reserves backing these stablecoins should be straightforward; with fiat currency “the US Dollar,” being bought to back up each $1 stablecoin token. Tether has been clouded in mystery around it’s reserves. The other reserves suggest they are over collateralized to the stablecoin’s circulating supply for additional safety.

However, the Terra “stablecoin” (UST) is known as an algorithmic stablecoin. Algorithmic stablecoins use a variety of reserves to support their $1 token, in addition to using algorithmic mechanisms to burn native tokens, mint new tokens or remove native tokens from circulation. UST’s algorithmic mechanism and yield generation was unsustainable, leaving it vulnerable to potential attacks.

Several months ago, the Terra project made the controversial decision to begin purchasing Bitcoin to use as a reserve asset for their UST Stablecoin. The intention was to have 30%-40% of UST’s reserve in Bitcoin. Just last month, the project’s reserves totaled 85,000 Bitcoins (~$3 billion). When the UST stablecoin began to de-peg, Terra sold a majority of their Bitcoin in days in an attempt to save Luna, which, in effect, tanked the Bitcoin price. The abrupt sell-off created a domino effect, bringing down the entire cryptocurrency market. With equity markets also experiencing volatility, fear and panic selling, we had the perfect environment for a death spiral black swan event.

In conclusion, the Terra Luna project is a stark reminder of the risks involved in investing in highly speculative assets. Crypto projects have failed before but none in such spectacularly rapid fashion as Terra Luna. While a now humbled Do Kwon vows to restore Terra, there is little to salvage for investors who have lost significant investment.

Key Takeaway: We feel for those who’ve been affected during this collapse. Massive portions of financial portfolios have been completely wiped out with this event, leaving the entire cryptocurrency market vulnerable to the trust of investors (retail and institutional). In short, this a black mark on mass adoption of blockchain technology in the near term. If there is a light at the end of this tunnel, it’s a reminder to learn valuable lessons from this situation;

Before investing, study and research the background of the team behind a crypto project.

Research the mechanics and business model of the project.

Don’t become emotionally invested in the assets in your portfolio.

Don’t use leverage, ever.

Understand that just because something or someone is popular, does not make them immune to failure.

And finally, don’t be this guy…

A Nation of (slightly less) Inflation

Last week, the Bureau of Labor Statistics released the CPI inflation rate for April, and although the overall inflation rate of 8.3% has cooled from 8.5% in March, those numbers were still higher than analyst expectations of 8.1%. The financial markets took a downturn on the news. Many analysts believe the inflation rate has peaked, which could restore confidence across financial markets.

NFT Corner with TPan

"Azuki is one of the top projects in the NFT space. However, their founder's past was revealed, causing a large commotion. Find out what happened at NFTs with TPan."

In the sky: Emirates to accept Bitcoin payments

Key Takeaway: “Emirates is embracing new technologies such as the metaverse and NFTs to expand its reach”, according to chief operating officer Adel Ahmed Al-Redha. (source: Cointelegraph)

Sorare to launch Major League Baseball Ethereum NFT fantasy game

Key Takeaway: “The MLB game will similarly offer up digital trading cards of professional players represented as Ethereum-based NFT collectibles, which can be bought and sold.” (source: decrypt)

A Conversation With Web3 🎙

“A Conversation With” the podcast is on Apple iTunes & Spotify. Hear from industry leaders and professionals as they share their web3 journeys, thoughts, and ideas empowering you to invest early.

📆 Wednesday, 5/18 @ 9 PM ET: Julie Pacino

This Wednesday, we welcome Julie Pacino, photographer, filmmaker, NFT artist & collector. Join us this Wednesday to hear directly on A Conversation With!

Consensus 2022

Win 2 passes to Consensus 2022 in Austin, TX by entering the tweet below:

investrly is written weekly by Founder Michael Rippe, with edits and design by Chief Strategist Danny Bopp. Thank you for reading. Share this newsletter with a friend or colleague by slapping the button below and help us continue growing!