Gambling in the Margin Casino 🎲

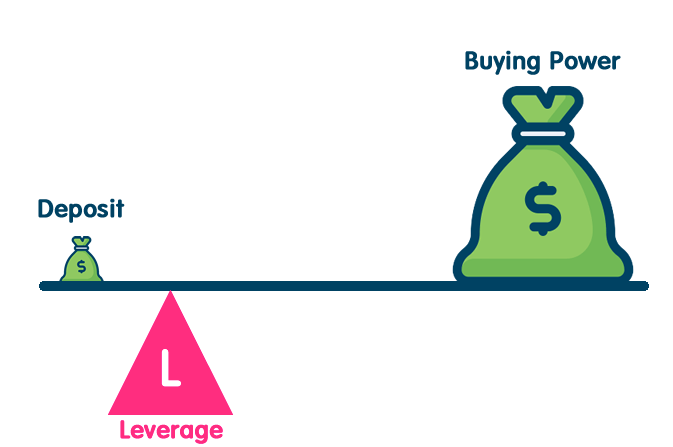

The Tipping Point of Leverage

March Madness 🏀 Cryptocurrency Style

Quality Weekly Articles 📰

Bill Hwang’s High Stakes Bets

Bill Hwang. A name that’s become infamous on Wall Street over the past week. Take a look at how and why he caught headlines in the first place:

After many years working in the hedge fund industry, Hwang began his own fund in 2000 called Tiger Asia, focusing on primarily Asian stocks. His firm quickly grew to manage over $3 billion of investors money and became known for making large, leveraged bets on various stocks. This strategy worked well for his firm…until the financial crisis of 2008. After four years of court cases and litigation, Tiger Asia pleaded guilty to federal insider-trading charges and was forced to return funds to investors. Hwang was personally fined $44 million, charged for insider trading and barred from trading public money for a minimum of five years. Many major banks, including Goldman Sachs, closed off business dealings with Hwang or so we thought.

In 2013, Hwang founded Archegos Capital Management, as a family financial firm. Unlike traditional hedge funds, family offices don't have to disclose investments and are shielded from regulators. This loophole was all Hwang needed.

As Archegos grew, Hwang’s relationships with banking institutions became close again. Hwang began borrowing from these banks to make extremely risky derivative trades, leveraging up to five times his assets. Borrowing more than he could afford and making casino-like bets. His largest positions, ViacomCBS and Discovery Communications, which had been going up and up…started going down and down. In a matter of days, both stock prices were cut in half and Archegos was hit with a margin call. When the “family financial firm” couldn’t meet the call, they were forced to liquidate 30 million plus shares and the equivalent of over 20 Billion dollars were lost between Archegos and the banks.

In a matter of days, Bill Hwang’s Archegos cemented it’s name in history for all the wrong reasons. A long term lesson on how margin, leverage, and gambling with money you don’t have is not the right strategy.

He built a $10 Billion investment firm. It fell apart in days - NY Times

What is Margin?

Margin is the money borrowed from a brokerage firm to purchase an investment. It’s the difference between the total value of securities held in an investor's account and the loan amount from the broker. Buying on margin is the act of borrowing money to buy securities.

Why buying stocks on margin is considered more risky than traditional investing? - Investopedia

March Madness Crypto

We started with 68 and we’ve reached the elite 8 of the March Madness Crypto tournament. Join us this week on twitter to vote and determine the top cryptocurrency to invest early in 2021!

Quality Weekly Articles 📰

Cryptocurrency

Goldman Sachs close to offering bitcoin and other digital assets to its rich private wealth-management clients - Markets Insider

Visa to allow partners to settle fiat transactions with crypto - Cointelegraph

Stocks

Expand Your investrly Opportunities

Premium Newsletter Subscription (this month)

Exclusive interviews with financial pros

Technical analysis

Weekly recommended stocks and cryptos

A monthly, long form, deep-dive newsletter guiding you to become a successful long-term investor.

Follow investrly on Social Media

Looking to partner? Reach us at weinvestrly@gmail.com.

investrly is written by Michael Rippe and edited by Danny Bopp with design elements from Peak Creative Design. Have a suggestion, comment, or question? Share it with us and share this newsletter with a friend so they too can invest early. See ya next week!