investrly Strategy 🌐 Portfolio Weighting

investrly All-Star Team (Top 7 Overall)

investrly Stock and Crypto of the week 📈 (Vuzix / Bancor)

investrly Education of the week (Term, Quote, Recommended)

Interested in discussing investing live and having your questions answered? Join the next investrly zoom call, Monday 2/22 at 4:30PM PT / 7:30PM ET.

investrly Strategy of the Week

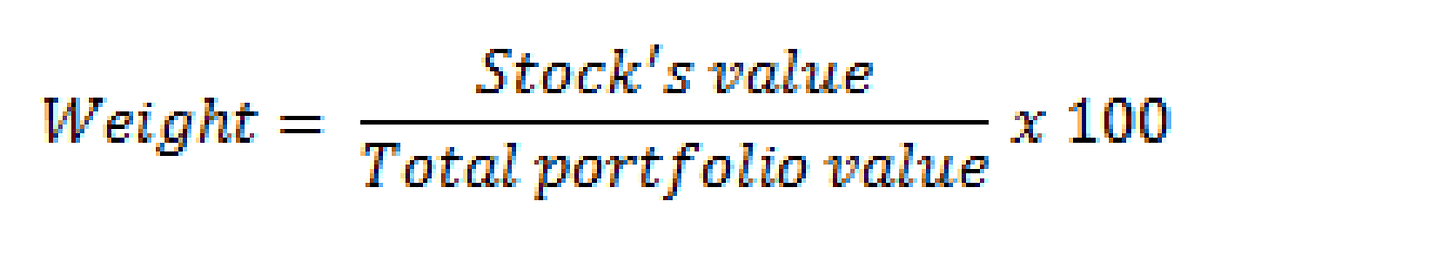

(Portfolio Weighting)

Successful investing means creating and executing on a plan, over and over. This plan includes the strategy of portfolio weighting, which is the percentage of each individual position inside an overall portfolio. Fundamentally speaking, this helps you recognize when positions become too big or small. Additionally, it can take the guesswork out of knowing when and how much to buy or sell.

For example, let’s say your goal is to make every position 3-5% of your overall portfolio. When planning to make an investment, you’ll know exactly how many shares you want to purchase to execute this plan. When selling, you’ll know when it’s time to take a profit by trimming if a position grows larger than 5%. The benefit can be twofold: You can lock in profit while continuing to own the position in the same percentage weight as when you initiated it.

As we have said in the past, successful long-term investing involves making and executing a plan. Understanding and incorporating this strategy will help execution, diversification, structure and overall portfolio process. In the future, we will break down different weighting recommendations. For now, keep it simple and start here by adding portfolio weighting to your overall plan.

How to Calculate the Weights of Stocks (Motley Fool)

Portfolio rebalancing is a powerful investment strategy (CNBC)

investrly All-Star Team (Top 7 Overall)

Where you can investrly in cryptocurrency. (Gemini)

Where you can investrly in stocks. (Public)

investrly Stock

VUZIX - $VUZI

Vuzix, a leading supplier of Smart-Glasses and Augmented Reality (AR) technologies with products in consumer and enterprise markets, finds itself in a sweet spot. Vuzix products offer users a portable high-quality viewing experience, provide mobility solutions and augmented reality. The covid pandemic created an opportunity with a rapidly evolving telemedicine field in major need of these products. With focus and innovation, Vuzix has a chance to set the industry standard. We see opportunity. So does top investment firm Ark Invest.

Ark Invest invests in smart glasses player Vuzix (Seeking Alpha)

investrly Crypto

Bancor Network - $BNT

Cryptocurrency is here and it’s a lot more than Bitcoin. Enter “Bancor Network”, an on-chain liquidity protocol that enables automated, decentralized exchange. Yesterday, the protocol passed $1 Billion in Total Value Locked (TVL). TVL is one of, if not the most important metrics when evaluating these opportunities. In the investrly 3.0 newsletter, we spoke about another protocol called AAVE, which we are also very excited about. The similarities in the growth trajectory of Bancor that we saw with AAVE are undeniable. If we are correct, we think this will go much higher very quickly. You can find and invest in this token on Coinbase and Coinbase Pro amongst other cryptocurrency exchanges.

Bancor Network – What You Need To Know and How To Use It (Altcoin Buzz)

investrly Term of the Week

Portfolio Weight

Portfolio weight is the percentage of an investment portfolio which a particular holding or type of holding comprises. The most basic way to determine the weight of an asset is by dividing the dollar value of a security by the total dollar value of the portfolio.

The Paradigm Shift To Self-Directed Portfolio Construction (Forbes)

investrly Quote of the Week

investrly Clubhouse collaboration with subSPAC

Clubhouse is all the rage and we’ve teamed up with Bill SPACman. Join us Friday afternoon at 1:20 PT/4:20 ET in the Clubhouse App for SPAC Happy Hour. We wrap up the week interviewing an industry insider while talking SPACs and breaking down the investing scene.

Reviews from the first two weeks have been great. Don’t miss it!

investrly Recommended

invest early in yourself: Want more help

investrly Personalized Options:

Book a 30 or 60 minute personalized 1-on-1 audio call (NEW OPPORTUNITY)

Premium+ Newsletter Subscription (COMING SOON)

Weekly stock commentary recap and monthly long form weekender

Join the @investrly community on social media:

Have a suggestion, comment, or question? Share it with us!

Looking to sponsor or advertise in a future newsletter? Reach us at pleaseinvestrly@gmail.com.

investrly is written by Michael Rippe and edited by Danny Bopp. See ya next week. Share this newsletter with a friend so they too can invest early. Get more investrly daily on twitter.

Not financial or tax advice. Investrly the newsletter is 100% educational and is not investment advice or a solicitation to make any financial decisions. This newsletter is not tax advice. Talk to your accountant and do your own research.